Wir schaffen nachhaltig

Sicherheit für Generationen.

Versicherungsverband Österreich

Über uns

Der VVO vertritt die Interessen aller in Österreich tätigen privaten Versicherungsunternehmen.

Unsere Services

Alles zum Thema Auto, Versicherung und mehr.

Presse

Der VVO bietet einen breiten Einblick in die vielseitige Themenwelt der Versicherungswirtschaft.

Aktuelle VVO Themen

-

Aktuelles aus der Versicherungswirtschaft

Laut Studie des Rückversicherers Swiss Re – Österreich an 4. Stelle bei Unwetterschäden im Verhältnis zum BIP. Zürich (APA/dpa-AFX) – Die Philippinen erleben nach …

-

Presseaussendung

Über 50 Millionen Verträge, Leistungen an KundInnen um 5,0 Prozent auf 17,6 Milliarden Euro gesteigert und Prämien auf 20,3 Milliarden Euro erhöht – die …

Versicherungsrundschau 3/2024

In dieser Ausgabe finden Sie u.a. einen Beitrag über die neue europäische KI-Verordnung, den Artificial Intelligence Act (AIA) …

Die beliebtesten VVO Services

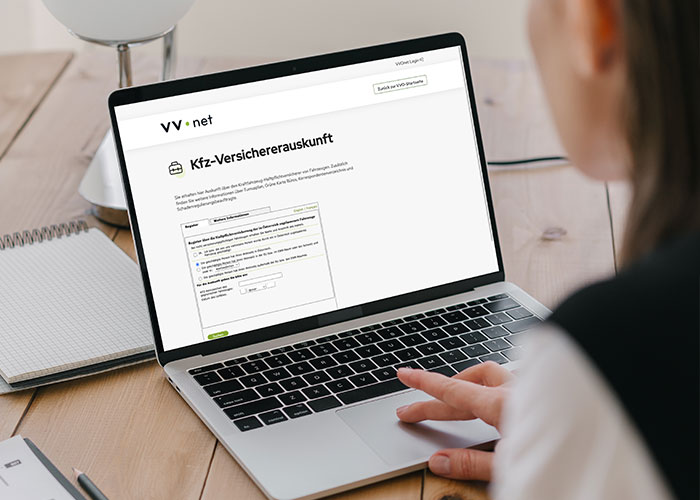

Kfz-Versichererauskunft

Wer ist der Haftpflichtversicherer von Fahrzeugen? Hier finden Sie alle Informationen.

Informations- und Beschwerdestelle

Sie haben Fragen zu Ihrem Versicherungsvertrag oder Probleme mit einer Versicherung?

Kfz-Zulassungsstellenauskunft

Hier finden Sie schnell und einfach die nächste Kfz-Zulassungsstelle an Ihrem Wohnort.